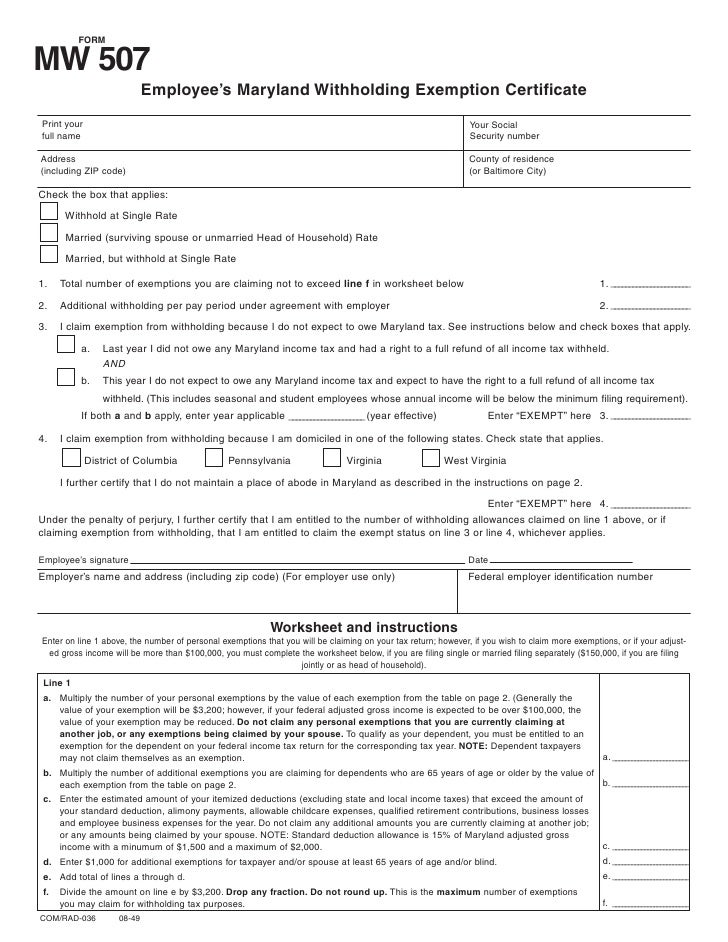

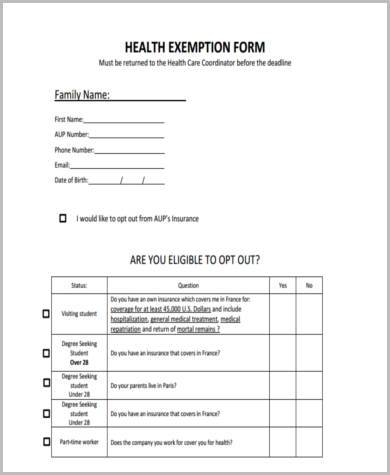

Bupa Tax Exemption Form / Employee's Maryland Withholding Exemption Certificate / Taking full advantage of rit's sales tax exemption is an excellent way to stretch budget dollars and to save department and rit a considerable amount in.

Bupa Tax Exemption Form / Employee's Maryland Withholding Exemption Certificate / Taking full advantage of rit's sales tax exemption is an excellent way to stretch budget dollars and to save department and rit a considerable amount in.. Bupa's management of tax risk is aligned with this approach and is set out in our enterprise tax policy. (for use by a virginia dealer who purchases tangible personal property for resale, or for. Institutions seeking exemption from sales and use tax must complete this application. Exemptions were once available to almost all tax filers in the form of the personal exemption. These forms are to be used for rit business purpose only.

Tax exemption helps in curtailing the burden of taxable income during a financial year. Taking full advantage of rit's sales tax exemption is an excellent way to stretch budget dollars and to save department and rit a considerable amount in. Usage of sample tax exemption forms. The samples provided in the links assures one thing, you get the best idea in the our sample tax exemption form is not only is useful for earners but it also gives a comprehensive idea about the entire process, and a law student can get an insight into the practical. A tax exemption, as most taxpayers experience it, is the right to subtract some portion of income or homeowners must apply for them and demonstrate their eligibility.

These exemptions are used for instance for the exports of goods from the eu to third countries and also for intra eu supplies of goods dispatched from one eu country to a business in another.

With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget. Various property tax exemptions are available to qualified applicants. The government may wish to promote one form of business/income today and may want to promote another. Association of persons formed for managing the collective interests common to all its members in respect of expenditure applicable to the common immovable. These exemptions are used for instance for the exports of goods from the eu to third countries and also for intra eu supplies of goods dispatched from one eu country to a business in another. Institutions seeking exemption from sales and use tax must complete this application. If you have any questions regarding tax forms, or are unsure if your group needs one to host a fundraiser, you can check out this post! Taxpayers who choose to itemize their. Commonwealth of virginia sales and use tax certificate of exemption. Attach a copy of your federal determination letter from the irs showing under which classification code you are exempt. This tax break focuses on items you can deduct on your tax form on an ongoing basis, over the course of the year. Taking full advantage of rit's sales tax exemption is an excellent way to stretch budget dollars and to save department and rit a considerable amount in. You may claim a tax exemption for tax year 2017 for each dependent if all of the following statements are true dependent tax exemptions can only be claimed on form 1040a or 1040.

This tax break focuses on items you can deduct on your tax form on an ongoing basis, over the course of the year. (for use by a virginia dealer who purchases tangible personal property for resale, or for. An aspect of fiscal policy. Taking full advantage of rit's sales tax exemption is an excellent way to stretch budget dollars and to save department and rit a considerable amount in. A tax exemption form is usually used to keep an organization that has been granted tax exempt status from having to pay taxes, such as sales taxes or a use or excise tax.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions.

Usage of sample tax exemption forms. To be exempt, an organization must meet the requirements for exemption as set by the code of virginia and the code of county of fairfax. Exemption numbers or exemption form* (if applicable). This video will give you step by step instructions on how i became tax exempt on my purchases for my ebay dropshipping business. Property tax exemption request (10/20). These forms are to be used for rit business purpose only. The global tax director, the chief financial officer we are compliant with action 13 of the beps project which significantly increased transparency standards in the form of new requirements for. Tax exemptions come in many forms, but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax. Association of persons formed for managing the collective interests common to all its members in respect of expenditure applicable to the common immovable. You do not include sales of exempt goods or services in your taxable turnover for vat purposes. Institutions seeking exemption from sales and use tax must complete this application. Bupa's management of tax risk is aligned with this approach and is set out in our enterprise tax policy. The government may wish to promote one form of business/income today and may want to promote another.

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax exemption refers to a monetary exemption which decreases the taxable income. Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites. Exemption numbers or exemption form* (if applicable). To be exempt, an organization must meet the requirements for exemption as set by the code of virginia and the code of county of fairfax.

Taxpayers who choose to itemize their.

Employees providing domestic services, such as respite or nursing, may be exempt from paying certain federal and state taxes based in some cases, the employer may also be exempt based on the employee's status. Your business is partly exempt if your business has incurred vat on purchases that relate to exempt supplies. General information tax exemption qualifications tax exemption application tax exempt purchases fundraising & sales tax. The samples provided in the links assures one thing, you get the best idea in the our sample tax exemption form is not only is useful for earners but it also gives a comprehensive idea about the entire process, and a law student can get an insight into the practical. Updated for tax year 2017. For instructions on how to upload your tax exemption form check out this article for a step by step process. A partial exemption from sales and use tax became available under section 6357.1 for the sale, storage, use, or other consumption of diesel the partial exemption applies only to the state sales and use tax rate portion. (for use by a virginia dealer who purchases tangible personal property for resale, or for. Attach a copy of your federal determination letter from the irs showing under which classification code you are exempt. Application for recognition of exemption under section 501(c)(3) of the internal revenue code. To print the tax exempt certificates click on the state link listed in the table below. Institutions seeking exemption from sales and use tax must complete this application. Fairfax county department of tax administration 12000 government center parkway, suite 223 fairfax, va 22035.

Komentar

Posting Komentar